THE HOUSING MARKET GOING INTO 2025: HOME SALES, RENTALS AND REMODELING

When you’re managing building schedules, land acquisition and product offerings, you need a solid grasp on the broader housing market. This includes shifting resale conditions, the competitive rental environment and consumer appetite for remodeling.

At the 2025 BFS National Event in January, Zonda Chief Economist Ali Wolf provided a status report on both the national and regional levels of the housing market and reported that professional builders should not view these different elements of the current market in isolation. These conditions and environments all converge to influence your sales velocity, pricing strategies and profitability.

HOME SALES AND INVENTORY: MORE AVAILABILITY, BUT SALES LAGGING

In 2024, many consumers stayed on the sidelines as they waited for the Federal Reserve to cut rates and see how the Presidential election turned out, but as we enter 2025, many of them remain on the sidelines because mortgage interest rates have risen above 7%.

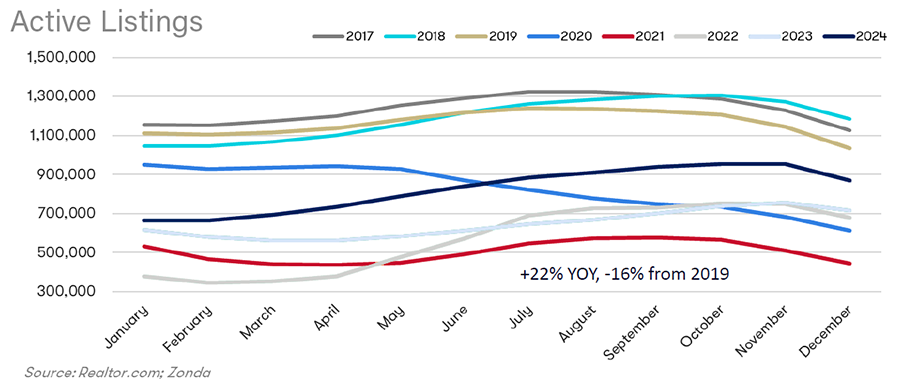

As a result, 2024 ended with the lowest level of existing home sales since the mid-1990s. However, there has been a shift in supply and we finished 2024 with 22% more inventory than in 2023. While we’re still 19% below where we were pre-pandemic in 2019, supply is moving in a positive direction overall. This is particularly good news for those in the remodeling space, as more listings usually result in more remodeling spending.

It’s important to note that this increased supply is not the case everywhere. Inventory remains tight in several markets, including those along much of the East Coast, Midwest and California.

Balanced markets hover at 4–5 months of supply; below 4 is a seller’s market and above 5 is a buyer’s market. In some Florida metros, supply is up to 10 months, which could slow new home sales if resale properties become more attractive bargains. Other regions, like the Northeast and California, remain tightly constrained, allowing builders to hold firmer on pricing.

KEY THINGS TO CONSIDER ABOUT THE RESALE MARKET

- More resales hitting the market at competitive prices

After five years of new homes essentially being the only game in town, the increasing resale supply creates more competition. - Undersupply in some areas and gross oversupply in others

Even in some areas that have higher inventory today, remember that it will be sub-market specific.

NEW HOME SALES: INCENTIVES AND NARROWING PRICE GAPS

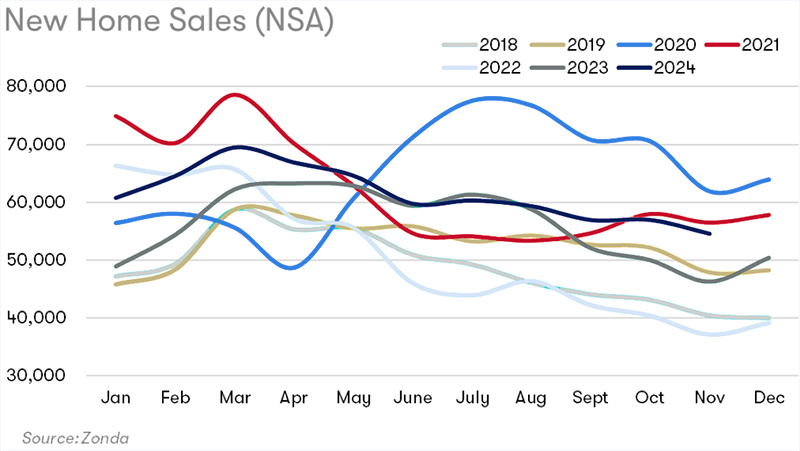

Historically, when there is higher resale supply, there are fewer new home sales and vice versa. According to Zonda’s numbers, new home sales are stronger than 2021, but not as high as 2019. Wolf says that’s a “good, healthy place to be.”

Nationally, new home sales “slightly overperform” though it varies by location, similar to the resale market. However, in some places with strong sales, this is due in large part to builder incentives like mortgage rate buydowns and closing cost assistance. Such incentives can reduce buyers’ effective interest rate, for example, from 7% down to the 5% range.

A buyer who is interested in moving may be unable or unwilling to move from a 3% interest rate on their existing home to a 7% interest rate on a resale home. However, moving to a new home could make more sense if a builder is willing to buy down the interest rate. Wolf indicates 75% of quick move-in homes currently offer incentives, hitting 95% in some Florida communities.

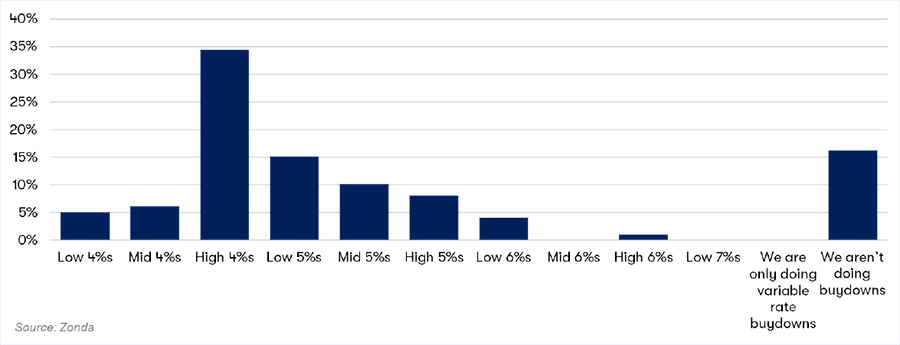

For this survey, builders were asked, "If you are offering mortgage rate buydowns, what rate are you willing to pay for and able to get for fixed-rate mortgages? Please select all that apply."

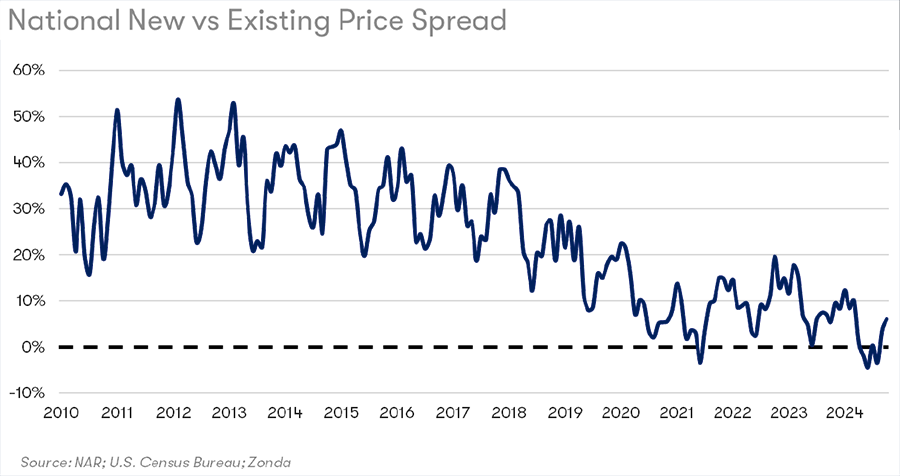

Traditionally, new homes carry a 20% price premium vs. comparable resales, but that spread narrowed to 6%. Lower insurance premiums that come with new homes also help builders compete against existing homes—so long as your product and price point align with local demand. Changes in home size, product and location are all contributing factors to those price points. That said, this narrower margin may require careful cost management.

HOUSING STARTS FORECAST

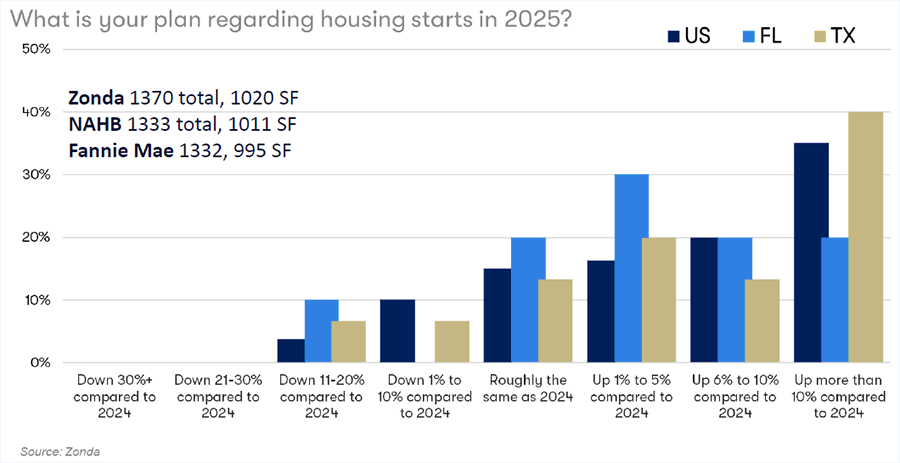

Wolf projects 2.5% growth in single-family housing starts for 2025. Public builders now claim 50% of the national market share (double their 25% in 2005) and have the resources to expand. Although some local markets, like parts of California, show community counts down 60%, others like Florida and Texas are heating up.

Nationally, over 50% of builders surveyed said they expect housing starts to be up more than 6% compared to 2024, with 30% expecting at least a 10% increase.

HOUSING AFFORDABILITY AND THE RENTAL MARKET

Home prices and inflation both spiked during the pandemic. While this was great for many people who already own a home because they saw sharp increases in equity, it has made affordability very difficult for those wanting to buy their first home.

The cost of ownership has risen to be 60% more expensive than renting. Historically, the difference is around 6%. As a result, the demand for entry-level buyers is lagging. If you serve first-time buyers, you might see slower absorption or need heavier incentives. Major apartment real estate investment trusts (REITs) are reporting high renewal rates because renters see a bigger financial leap to buying.

CONCESSIONS AND REGIONAL DIFFERENCES

Nationally, multi-family construction has seen a dramatic pullback and slowdown. This is more because of oversupply than demand. However, as with single-family construction, the trends are different regionally.

Multi-family construction boomed from 2022 to 2024, delivering record levels of new units. In many Sun Belt cities, that’s led to higher vacancy rates and increased concessions (e.g., a month of free rent). Meanwhile, the Midwest, Northeast and California maintain tighter rental inventories, so rents are still climbing steadily. For builders, this means your competitive strategy could differ drastically by region.

MULTI-FAMILY FORECAST

In some markets, 2024 was the low point and things could look a little bit better this year. Other markets, unfortunately, aren’t fully through that low point. Zonda does anticipate seeing growth in the multi-family market going into 2026 and ’27.

REMODELING FORECAST: GROWTH, BUT WATCH TARIFFS

Remodeling construction has the potential to see a golden era in the years ahead. Here are three main reasons why:

- Many owners with low mortgage rates feel “stuck” in their current home, so they remodel instead of moving

- National tappable equity surged by $12 trillion over five years, which is 40% of U.S. GDP

- An aging housing stock (“the oldest on record”) requires ongoing updates and improvements

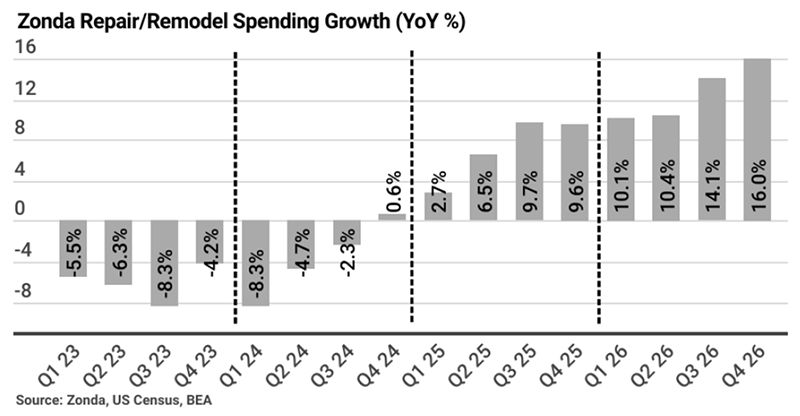

Zonda’s remodeling expert, Todd Tomilak, expects 7% remodeling growth in 2025 over 2024, and possibly double-digit growth by 2026.

The biggest potential caveat is tariffs on building materials, which, according to Tomilak, could increase costs by 6–14%. If tariffs rise and building products are not excluded, this inflation might stall some remodeling projects unless mortgage rates simultaneously drop to ease affordability concerns.

For professional builders, understanding home sales and inventory reports, rental trends and remodeling activity can guide product mix and incentive offerings. Balancing all these pressures will be key to sustained profitability.