EXAMINING MORTGAGE RATES IN EARLY 2025

Few factors loom larger over economic conditions than the Federal Reserve and its monetary policy, which ultimately shape homebuyer demand, financing costs and your own strategic decisions. Although the Fed influences short-term rates rather than mortgage rates directly, it shapes market sentiment and borrowing costs that affect your homebuyers.

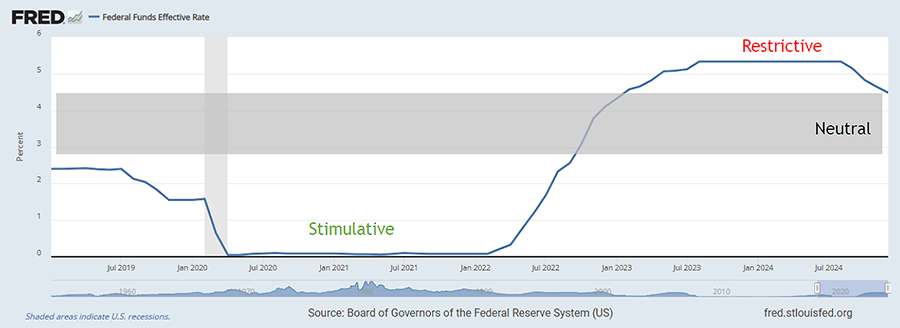

SHIFTING MONETARY POLICY: STIMULATIVE, RESTRICTIVE AND NOW NEAR NEUTRAL

The Fed’s Journey Since 2020

- In early 2020, when the pandemic struck, the Fed dropped the federal funds rate to near zero to stimulate the economy.

- By 2022, it reversed course to cool inflation, raising rates rapidly and ushering in “restrictive” policy.

- In late 2024 and into 2025, the Fed cut rates by 100 basis points, moving closer to a “neutral” stance where policy is neither actively boosting nor restraining growth.

The resulting impact of these fluctuations to the federal funds rate has been that we’ve returned to a more normalized labor market. This is evident in different metrics, including overall jobs added, unemployment rate and labor force participation rate.

However, the return to neutral does not guarantee lower mortgage rates for your buyers. As Wolf emphasizes, “The Fed does not control mortgage interest rates, investors do.”

INFLATION, EMPLOYMENT AND FED CAUTION

The Fed’s dual mandate is maximum employment and stable pricing. With labor force participation and job creation near “full employment,” the Federal Reserve would say they’re not nervous about the employment backdrop.

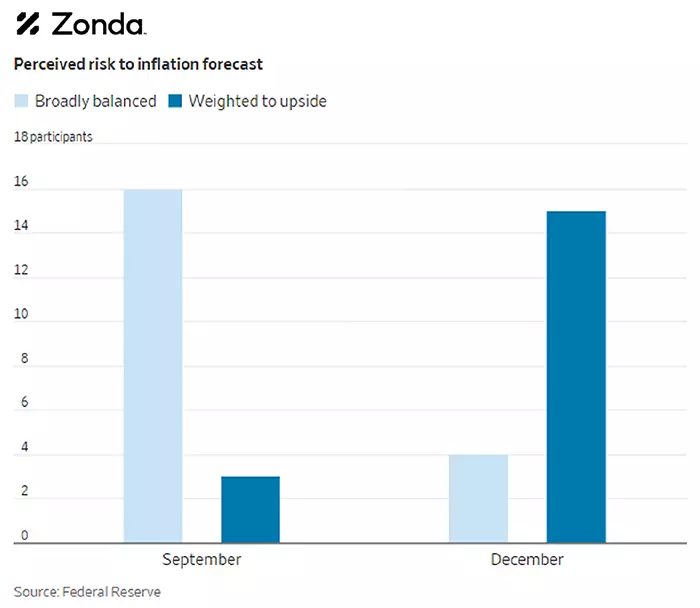

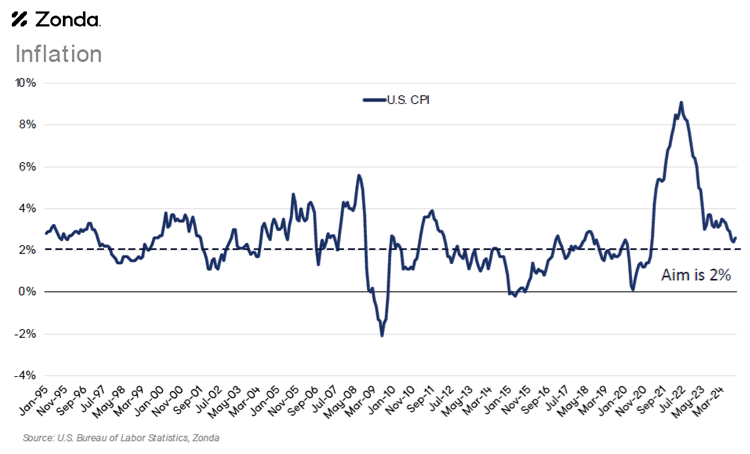

However, inflation remains between 2% and 3%, below earlier peaks but still above the Fed’s 2% goal. When the Fed cut rates in September, they said they saw a balance of risk, and they liked the stability. In December, per Wolf, the Fed signaled a new stance. “The risk is that inflation is going to go up. We no longer think it’s balanced.”

This makes policymakers wary of additional rate cuts, which could keep mortgage rates elevated.

POLITICAL SHIFTS AND INVESTOR SENTIMENT:

PRO-GROWTH POLICIES WITH INFLATIONARY SIDE EFFECTS

The new administration in Washington, D.C. supports domestic-first, lower-regulation policies. While that can help spur business activity, it might also reignite inflation if combined with other policies including tariffs, deportations or high spending levels.

National debt and deficits remain high, which further influences borrowing costs for your buyers. If you have higher inflation, that also means higher interest rates.

Despite the Fed’s recent rate cuts, investors anticipate “higher for longer” interest rates due to these strong economic indicators and inflation risks. For builders, that means prospective buyers might hesitate if they’re holding out for 4% or 5% mortgages that don’t materialize. Adjusting your incentive strategies and managing margin pressures could be vital.

However, the good news is that there is potential for real improvement. If inflation stabilizes or tariffs remain manageable, cost pressures could ease, fueling stronger builder confidence. Even a 0.5% drop in mortgage rates can significantly drive up traffic, so it’s important for builders to continue watching economic releases and statements from the Federal Reserve.

WHY MORTGAGE RATES REMAIN HIGH

- Since investors price in risk, they raise mortgage rates to hedge against potential inflation or policy changes. Wolf notes, “Investors are stepping back and saying, okay, the Fed is changing their tune, we need to change our investments accordingly.”

- Builders must track these sentiment shifts because even small swings in mortgage rates can affect buyer traffic and contract signings.

As a builder, it’s crucial to understand how Fed policy, inflation and investor sentiment converge. Even if the federal funds rate drops, mortgage rates may not follow suit when market perceptions of risk remain high. That calls for flexible planning, possibly including strategic land buys, incentive offerings and realistic projections of consumer buying power. Expect mortgage rates to remain higher than pandemic lows for some time, and structure your pipeline accordingly.