WHAT TO KNOW ABOUT THE SUMMER 2024 HOUSING MARKET

August 1, 2024

ECONOMIC BACKDROP

The economic landscape presents mixed signals. Wolf described the latest GDP report, the broadest measure of the economy, as “very good,” but the details of the report are more complicated. The report indicated that the economy is still being driven by consumer spending, but there is a division among consumers. Some continue to spend by dipping into savings and increasing debt, leading to rising credit card and auto loan delinquencies. This group, primarily lower and middle-income households, have been hardest hit by rising prices.

That being said, another subset of consumers, who have seen their incomes and asset value rise, is spending without depleting savings. This dichotomy reflects broader economic health, where inflation rates are cooling, and unemployment has slightly risen to 4.1%, indicating a cooling yet balanced economy. Jerome Powell, chairman at the Federal Reserve, said he feels much more confident about the economy today.

HOUSING MARKET TRENDS

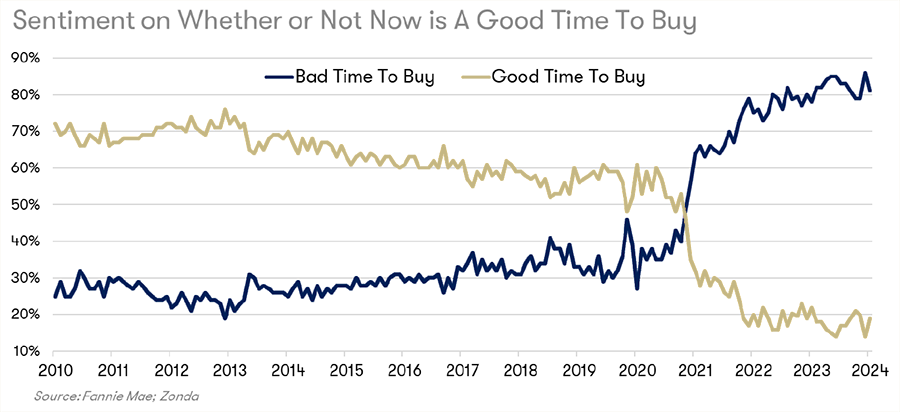

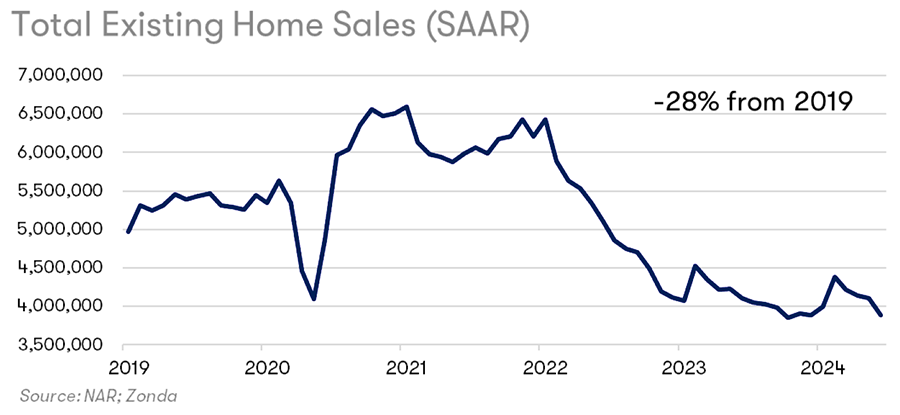

Resale Market: The resale market is witnessing significant consumer hesitancy. Fannie Mae's survey reveals that 80% of consumers believe it’s a bad time to buy a home, a stark increase from the 30-40% range seen pre-pandemic. Existing home sales remain down 28% from 2019, highlighting a sluggish resale environment.

New Home Sales: Despite the challenges in the resale market, new home sales are following a traditional seasonal path. Builders are seeing a slightly overperforming market, although they acknowledge the increased effort and incentives required to secure sales. The Zonda Market Ranking (ZMR), which adjusts sales for supply and seasonality, shows a nuanced performance across different market tiers.

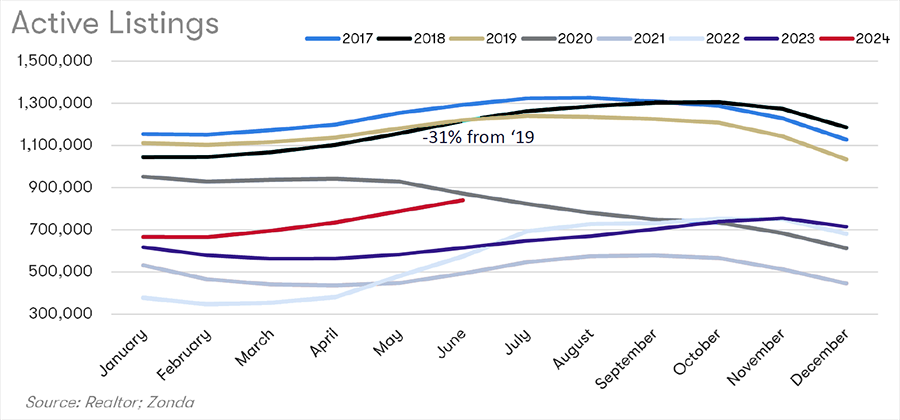

Housing Supply: Inventory levels, although up 37% compared to last year, are still down 31% from 2019 levels. This increase in active listings signals a healthier market, yet the supply remains constrained in many areas. However, certain markets have seen significantly higher listings compared to last year. Tampa is up over 90%. Parts of Florida, the Southeast, Colorado, Arizona, California and Texas generally have the strongest listing increases.

HOUSING MARKET FORECASTS

Single-Family Housing Starts: For the second quarter, housing starts were up year-over-year for all of the top 25 housing markets across the country. This is the first time in a long time that’s happened. Twenty of them were up compared to the second quarter of 2019.

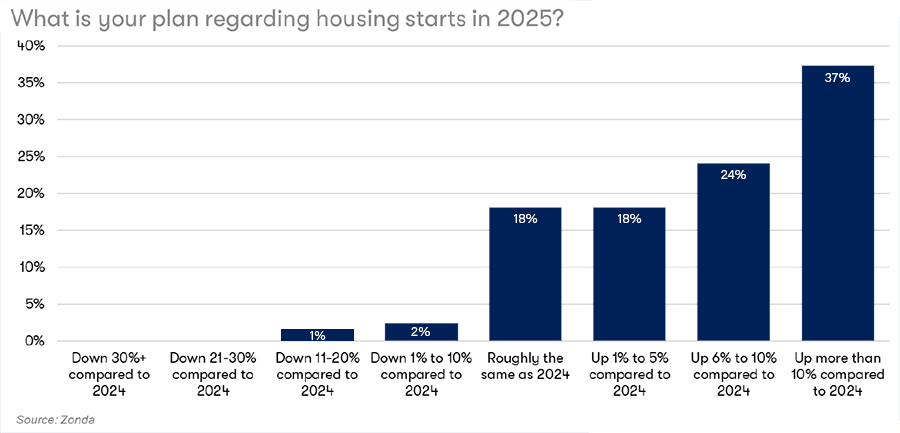

Builders remain optimistic about increasing housing starts, with 70% anticipating more starts this year compared to last. Builder enthusiasm is higher now than it was at this point in 2023. This optimism extends into 2025, supported by improved land and lot availability and forecasts of slightly lower mortgage rates.

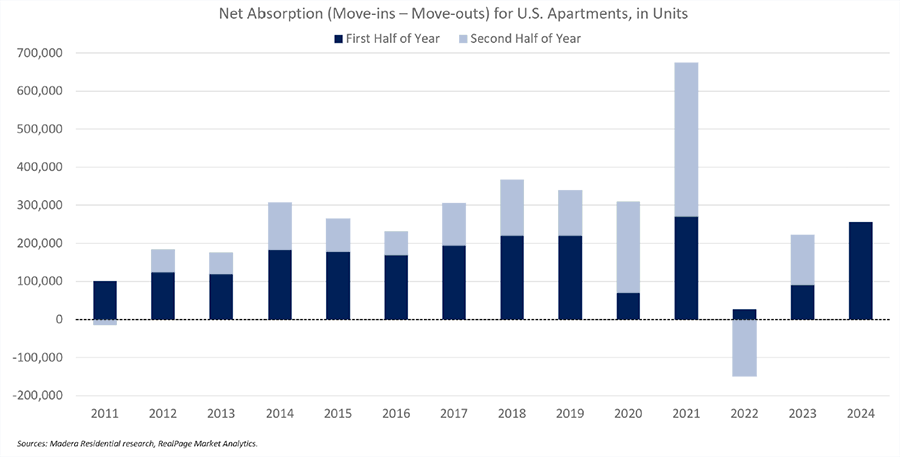

Multi-Family Market: Multi-family forecasts are suggesting a significant decline in starts. There is a pullback from the record levels of multi-family construction units seen during the height of the pandemic. This is attributed to economic uncertainty, availability of construction financing, and permitting challenges. However, a rebound is eventually expected as the market adjusts to current supply levels.

The rental market is experiencing a softening in some regions, with national rent levels flat to down. However, regional variations are significant. Rents continue to rise in the Midwest, Northeast, and Southern California, driven by supply constraints and better alignment of rental rates to incomes. Conversely, areas like the Sun Belt, which saw rapid growth and construction, are experiencing increased vacancy rates and declining rents.

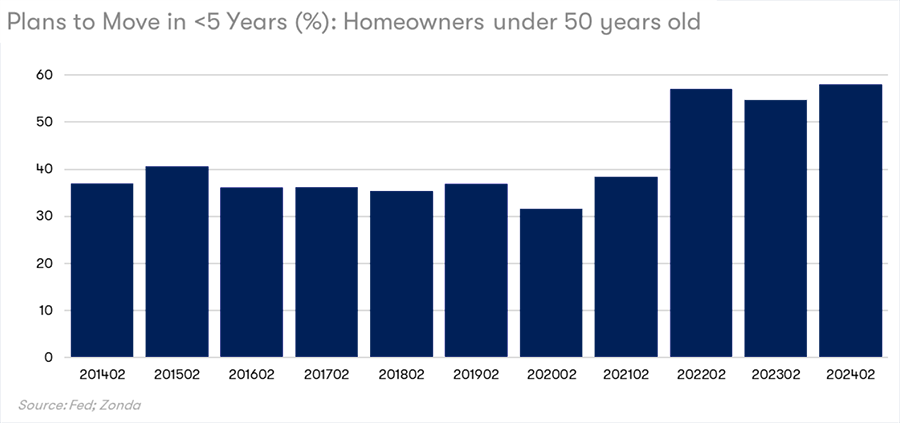

Consumer Sentiment: Federal Reserve data shows that 60% of residents under 50 years old plan to move in less than five years. That’s up from 40% in 2021. It seems like the demand is there, so once consumers feel like they’re happy with the value they can get in a home or happy with the interest rate, or both, they’ll start making moves.

Baby boomers, the second most active buyer group, are expected to pull back as the election approaches but should rebound post-election. Cost-sensitive buyers face more challenges due to affordability issues, inflation, and high mortgage rates, making the entry-level market particularly strained.

Affordability and Economic Risks: Affordability and economic risks remain long-standing issues in the housing market. Consumers will continue to move for life changes, jobs, and the desire for better living conditions, irrespective of broader economic trends.

The housing market is navigating a complex landscape of economic mixed signals, affordability challenges, and varying regional trends. It’s difficult to make blanket statements about the market because different facets of it are working much more strongly in different places. Data that’s applicable to one market or region may not be applicable to others.

While the resale market remains sluggish, new home sales show resilience, and the rental market presents a mixed picture, but optimism for new housing starts is growing. As the market evolves, staying informed about these trends will be crucial for consumers, builders, and investors alike.