THREE REASONS TO BE EXCITED FOR THE FUTURE OF THE REMODELING INDUSTRY

August 14, 2024

The remodeling market is an area of the building economy that isn’t currently at it’s strongest, especially with the recent overall decline in spending. However, there's a strong case to be made for optimism toward remodeling when looking toward the future of this industry. Despite the current dip, the long-term outlook is bright, with several key factors pointing towards a robust rebound.

Research from Zonda shows that today’s remodeling environment is similar to the environment of the late 1970s/early 1980s. Like now, people at the time were coming out of a period of economic uncertainty, deferring spending until things became more settled. But once people felt more comfortable, there was a significant rebound in remodeling. That lead to what some experts call a “golden decade” for remodeling, which could happen again.

In July’s Market Intelligence Webinar, Ali Wolf, the chief economist at Zonda, emphasized three reasons we could be on the brink of a “golden decade” in home remodeling.

1. AGING HOUSING STOCK

One of the most significant drivers of the remodeling market is the aging housing stock across the United States. Currently, the nation is tied for the oldest housing stock on record, with many homes being over 50 years old. This aging infrastructure is particularly prominent in regions like the Midwest, Northeast, and California, where older homes often require substantial structural updates. These homes are prime candidates for extensive remodeling projects, including necessary repairs, modernization, and aesthetic upgrades to meet contemporary standards.

Even in areas with younger housing stock, these homes are now entering what experts refer to as "prime remodeling years." This period is when homes, though not necessarily old, begin to need significant updates like new roofs, modernized kitchens, or cosmetic enhancements to maintain or increase their value. The aging housing stock, therefore, represents a substantial and ongoing demand for remodeling services, making it a key reason for optimism in the industry.

2. SQUARE FOOTAGE MISMATCH AND DISCONTENTMENT

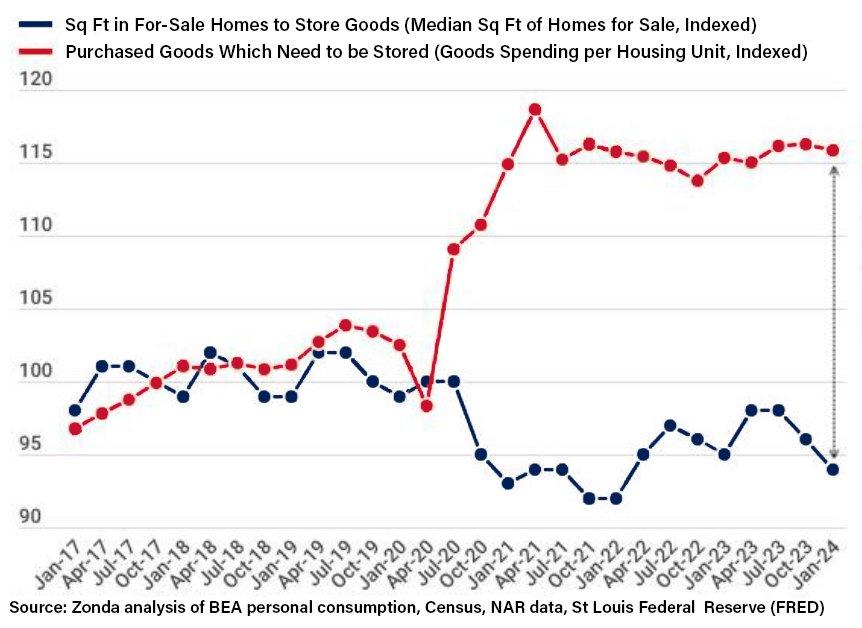

Another factor contributing to the bullish outlook on remodeling is the growing mismatch between the square footage of homes and the volume of goods homeowners accumulate. In recent years, the amount of durable goods purchased per home has increased, while the available square footage has decreased. This trend has led to a sense of discontentment among homeowners who feel cramped in their current spaces.

This discontentment is a significant motivator for remodeling. Homeowners are increasingly looking to renovate their spaces to better accommodate their lifestyles, whether that means creating more storage, expanding living areas, or reconfiguring layouts to make their homes more functional and comfortable. The desire to improve one’s living environment, coupled with the physical limitations of smaller homes, creates a ripe opportunity for the remodeling market.

3. RECORD LEVELS OF HOME EQUITY

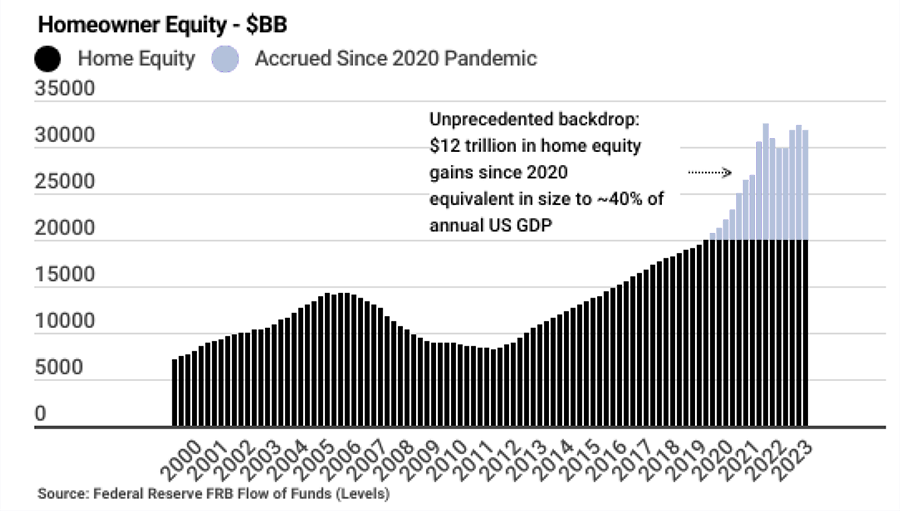

Finally, the recent surge in home equity is a powerful driver for remodeling activity. Since 2020, American homeowners have accrued an unprecedented $12 trillion in home equity. This vast reserve of wealth provides homeowners with the financial means to invest in significant remodeling projects.

With such substantial equity at their disposal, many homeowners are likely to opt for remodeling instead of moving, especially in an interest rate environment where buying a new home is less appealing for many people. The ability to tap into this equity to fund renovations gives the remodeling market a strong financial foundation, supporting growth in the years to come.

LOOKING AHEAD

While the remodeling market may currently be experiencing a downturn, the underlying factors suggest a very different story for the future. The combination of aging housing stock, increasing homeowner discontentment due to space constraints, and record levels of home equity points to a "golden decade" for the industry. As these trends continue to unfold, the remodeling market is poised for a significant rebound, making it an exciting space to watch and invest in.